Markup price refers to an add-on-the-cost price to form the selling price consisting of a required profit. This method has various elements that can make your business grow at a good pace. Thus, if you also want to make your pricing strategies wiser and more profitable for you. Please read this article carefully; we have mentioned almost everything you need to know about Markup Pricing.

What is the Markup Pricing?

Markup Pricing is a price difference between the cost and selling price of a product or service. Simply, you can also consider adding a percentage to the cost price of any product to form its selling price. We add this markup price to the cost of any goods or services to generate profit for any company, firm or individual. We have mentioned a simple markup formula below to illustrate this phenomenon better:

Cost of Goods or Services + Markup = Selling Price

Markup price meaning is to add a markup to the cost price of any goods or services to form the retail or selling price. Due to differences in the cost price in different locations, the markup price is also differentiated & the resulting different prices of different location is called geographical pricing. We have also mentioned a simple markup percentage formula that will help you find out the percentage of markup on cost:

Markup Percentage = [ (sales price - unit cost) / (unit cost) ] × 100

Every business and industry requires various needs and wants of markup. On the one hand, some industries can easily markup their goods and services pricing at large amounts, while on the other hand, some companies/industries can only afford to markup at lower percentages.

How to Calculate Markup Pricing?

Businesses need to use markup pricing to decide the selling prices of their products and services. There is a simple markup formula to determine the selling prices of products and services of a business.

Selling Price = [Cost ÷ (100 - percent markup)] × 100

For example, you have a racing car toy costing $50, which you need to sell at a 60% markup. Thus, in this case, any business can easily calculate its selling price by using this markup rate formula. You will calculate the selling price of the racing car toy as follows:

Selling Price = [$50 ÷ (100 - 60)] × 100]

Thus, it is a simple formulated calculation to determine any product or service’s selling price.

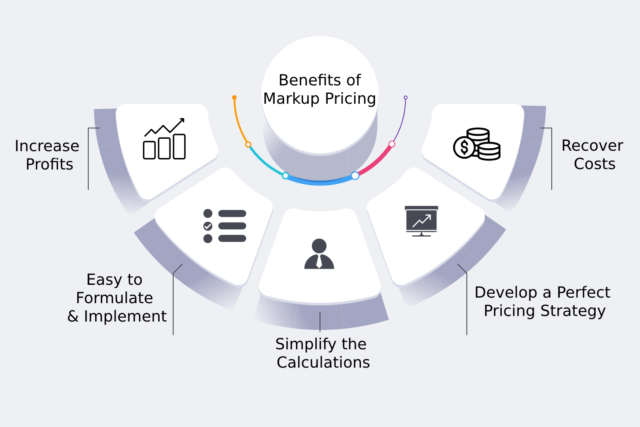

Benefits of Markup Pricing

It has various benefits to make the company touch different heights of success. We have mentioned here several undue advantages:

Increase Profits

The markup price formula helps set up strategic prices for the goods and services that help estimate and generate significant profits. Marking up the goods and services also helps offset any expense included in the cost of creating goods or services.

Recover Costs

Marking up the prices gives you a possible amount of profit you need to recover the cost spent on the labor and material. It always helps companies not to spend more than investing in creating goods and services. It will help your company to be safe from debt.

Simplify the Calculations

While dealing with the cost and selling price calculations, you have to go through many complicated calculations. But calculating markup has made things far more straightforward. This new concept has made equations a lot easier.

Develop a Perfect Pricing Strategy

The markup price formula helps create a fair selling price that covers all the costs of creating goods and services. Any business can easily set up its markup pricing. They need to consider their type of products or services, their demand and supply, and the availability of substitutes. If any company has finely set up its markup rate, it will save them a lot of time and money.

Easy to Formulate and Implement

The markup rate formula makes it easier for companies to formulate and implement selling prices. According to this method, businesses only need to decide the profit margin they want to keep after cutting their production cost and other expenses.

Limitations of Markup Pricing

Inefficient Results

The cost price of a product or service acts as a base price for setting up the markup price. This pricing strategy doesn’t have any control over the cost price. For instance, the price of any product is generally $50, and you sell it with a 20% markup at $60. But, if the cost price suddenly increases and becomes $60, your business will fall into the dilemma of adjusting the markup to generate profit.

Sometimes, Lower Profits

In many organizations, the markup percentage for all the products remains constant. This eventually leads the companies to lower profits. Therefore, uniform markup pricing is not advantageous from any perspective. It snatches the chance of charging higher in so many product ranges.

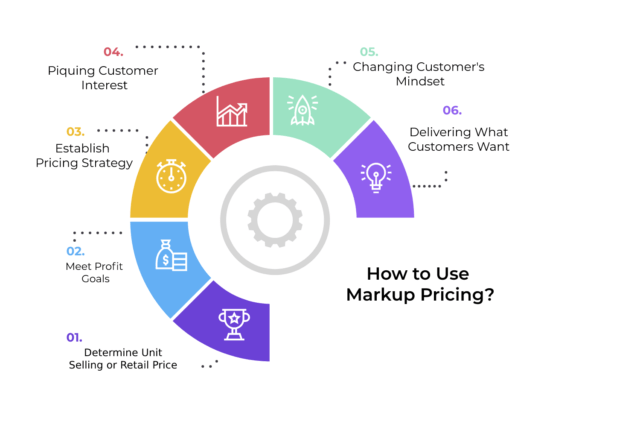

How to Use Markup Pricing?

Markup pricing can be widely used in any industry to improve a business’s growth. We have mentioned some of the secret ways here to implement for your business:

1. To Determine Unit Selling or Retail Price

Before deciding your retail price for your product or services, you should consider your required profit and how much higher it can go in the market. For instance, if you want a profit of 10% over your selling price, you need to add a 10% markup of the wholesale price.

2. To Meet Profit Goals

A business would be profit oriented only when it offsets its expenses. A strategic markup will protect you from any loss you might register during your product or service creation.

3. To Establish Pricing Strategy

Using this pricing strategy can help your business create an effective pricing strategy when you set up enough markup for your business to help you generate a decent profit. You start outperforming your competitors and capturing the bigger market.

4. Piquing Customer Interest

Using the markup price tactics can also change your customer’s perception of your pricing. Having specific markup changes before selling them can increase the customer’s interest in purchasing your product. Though customers will know that you’re optimizing tactics for selling your products, they will happily buy them.

5. Changing Customer’s Mindset

This pricing strategy can play with the customer’s mindset. Customers would love to buy from your sales instead of purchasing your products at your regular prices. It makes them purchase from your store every time you advertise a sale. It influences their mindset as they are saving their money. However, you will constantly get sales.

6. Delivering What Customers Want

Ultimately, markup prices solely focus on fulfilling the customer’s desires. Firstly, you analyze the data before determining prices and providing discounts. You can even decide the markup of the products that have yet to sell for longer.

Markup vs Profit Margins

Markup and Profit Margins analyze similar transactions but provide different sets of information. Profit Margins are referred to as a percentage of revenue after cutting the cost of goods. While the Markup Price is referred to as any amount added to the cost price of the product to form its selling price.

For example, a company generates $5,000, and the cost of production is $1000. Gross profit will come after deducting the cost of goods from the total revenue.

Gross profit Margin = [(Revenue - cost of goods sold) / (revenue)] × 100 Gross Profit Margin = [($5,000 - $1000) / ($5,000)] × 100 Gross Profit Margin = 80%

Markup is a product’s retail price minus its selling price. At the same time, the profit margins have different calculations. In several cases, markup prices may be the same as the profit margins. But they can not be called the same. The markup percentage is called the markup percentage of the cost, while the gross margin is the percentage of the revenue.

Considering the previous example, we have calculated the markup percentage as follows:

[($5000 - $1000) / ($1000)] × 100 = 400%

In simple terms, Profit Margins are the profit of the company in relation to its selling price or revenue, while the Markup is also a profit in relation to the cost of the product.

Final Words

Markup Pricing is very beneficial for setting up pricing strategies for any business. You mostly register profit after using it. We hope this article helps you know everything about it.

Frequently Asked Questions

What is markup price meaning?

Markup Pricing is a price difference between the cost and selling price of a product or service. Simply, you can also consider adding a percentage to the cost price of any product to form its selling price.

What is markup percentage formula?

markup percentage formula that will help you find out the percentage of markup on cost:

Markup Percentage = [ (sales price – unit cost) / (unit cost) ] × 100

What is markup pricing and example?

Markup percentage is calculated by dividing the gross profit of a unit (its sales price minus its cost to make or purchase for resale) by the cost of that unit. If an item is priced at $12 but costs the company $8 to make, the markup percentage is 50%, calculated as (12 – 8) / 8

What are the advantages and disadvantages of markup pricing?

Benefits of Markup Pricing

- Increase Profits

- Recover Costs

- Simplify the Calculations

- Develop a Perfect Pricing Strategy

- Easy to Formulate and Implement

Limitations of Markup Pricing

- Inefficient Results

- Sometimes, Lower Profits