Oligopoly Market Meaning

Oligopoly market structure involves only a few competitors in the market and referred to as imperfect competition.

In this form of market, products are homogeneous or differentiated and the number of sellers in the market are between two and ten.

For instance, the cold drink industry in India selling homogeneous as well as differentiated drinks in the market.

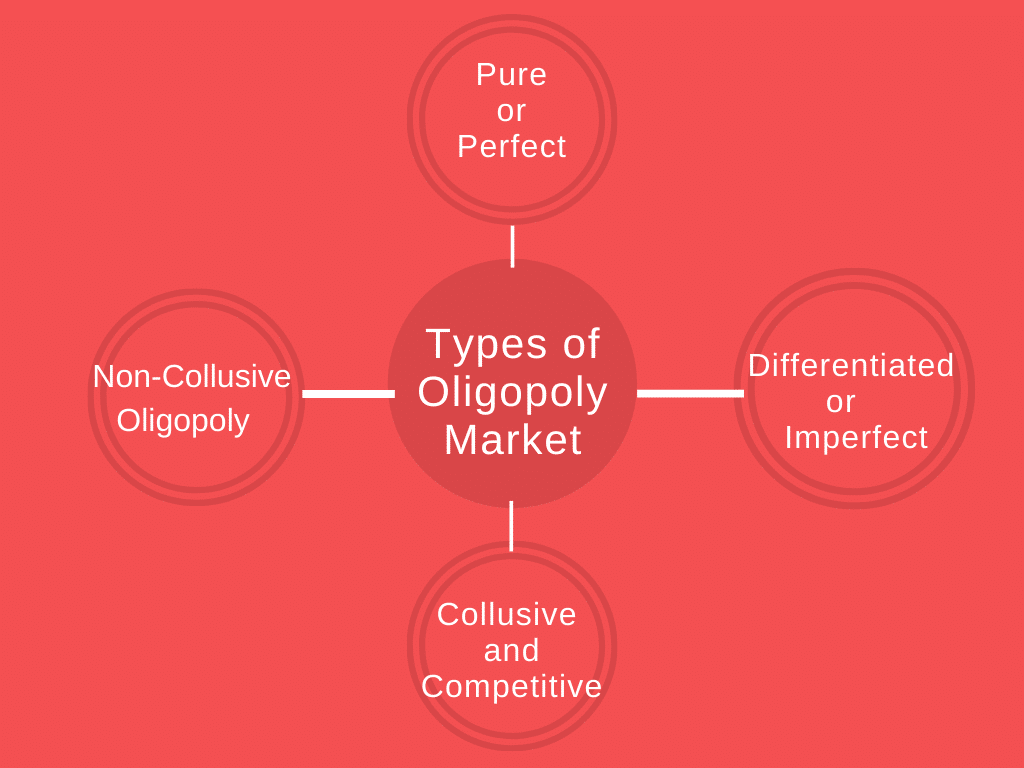

Types of Oligopoly Market

There are many different reasons which give rise to different types of an oligopoly market and gives the elaborated oligopoly meaning in economics.

Here are different reason and causes of different types of oligopoly market to illustrate the oligopoly meaning.

Pure or Perfect

Pure or perfect oligopoly market refers to the market which is having homogeneous products i:e similar products oligopoly market.

This type of market is very common around the world. For instance, cement, steel, aluminium and chemicals producing industries are some of the best examples of pure oligopoly market structure.

Pure oligopoly market, products are homogeneous i:e all the products in the market are similar.

So, the differences between the price of products will be rather insignificant. Hence, sellers are more interdependent in the case of a pure oligopoly market.

Differentiated or Imperfect

Differentiated or imperfect oligopoly market refers to the market which is having different products.

Like, passenger cars, cigarettes or soft drinks etc.

These industries produce products that are close to each other but each product has different characteristics.

Differentiated oligopoly market has different products, products in this market are different from each other.

So, the differences between the price of products will be insignificant. Hence, the interdependence among sellers decreases in the case of a differentiated oligopoly market.

Collusive and Competitive

In this form of market structure, few sellers in the industry set their prices and output of the product from mutual understanding.

It forms with firm collusion that is why it is called a collusive oligopoly. There is higher competition in the collusive market. Which result in a monopoly market from oligopoly.

In order to finish the price-cutting competition sellers comes to an agreement. Which gives rise to collusive oligopoly. The average cost is an important feature of the collusive market.

Non-Collusive Oligopoly

Non-collusive oligopoly refers to the market where firms behave independently but in reality, they are interdependent in the industry. Seller’s perception of the other sellers in the market decides their behaviour and decisions.

Sellers can only think about the possible reaction of other sellers if one firm makes any decision. Hence, studying rival firms behaviour becomes part of the firm’s operation.

These are the descriptive explanation of four different types of an oligopoly market.

Features of Oligopoly Market

Oligopoly features tell about the functioning of the market and the behaviour of the sellers. features of oligopoly market with explanations are:

Few Sellers

Few sellers and many consumers are the reflections of an oligopoly market. In oligopoly firms, the number varies from two to ten. Firms have good control over the market and the price. Also, sellers in the market keep a close observation of other seller’s behaviour.

Interdependence

Sellers in an oligopoly are dependent on each other because the decision of one firm affects the entire industry. Due to this, the seller studies the rival firm behaviour. Change in prices of one firm compiles other firms to do the same to keep their market share.

Advertising

Advertisement is the base to make the competition among the sellers more intense. Therefore, it takes a lot of firm resources on an advertisement on frequent bases.

Firms with high advertisement spending have a higher impact on the consumer, and it creates a negative image for others.

High spending on advertisement shows the high and positive impact on consumer and negative on other firms.

Competition

Due to less number of sellers in the market, the competition gets more intense; and, because of intense competition in the market decision of one firm affects the entire industry. Which makes the firms to keep in check with other firms activities and behaviour.

Entry and Exit Barriers

In an oligopoly market, the process for firms to exit from the industry is easy. There are no regulations or laws for firms while leaving the industry. However, there are certain barriers to new firms. Barriers can be classified as:

- Government license

- Patent

- Large firm’s economies of scale

- High capital requirement

- Complex technology, etc.

In some situations government regulations, policies favour the current or large firms in the industry.

Lack of Uniformity

There is no one size of the firm in the industry i:e size of the firms in the industry is not fixed. in most cases, the size of the firms, size differs considerably. Firms can be very small or big, this is called asymmetrical.

Existence of Price Rigidity

If one firm lowers its prices in the market it forces other firms to lower their prices as well to stay in the competition. Firms keep their prices at the lowest in order to gain a competitive edge. That leads to, a price war in the industry.

In order to avoid regular competition in the market, all firms keep their prices fixed, which results to price rigidity.

These are the six features of the oligopoly market that describes the oligopoly meaning in economics and oligopoly characteristics.

Price and Output Determination under Oligopoly

Product differentiation is based on the type of industry and determination of price and output, in the case of an oligopoly market. Which can be understood by the different models. Here is the differentiation of products in an oligopoly:

- Oligopoly market have few sellers and selling identical or homogeneous products and having a powerful influence on the whole market, the price and output policy of each is likely to affect the entire industry; therefore they will try to promote collusion.

- If the industry has the differentiation of products, an oligopoly market can increase or decrease its price without the fear of losing customers or comebacks from its rivals.

Price Determination Models Of Oligopoly

To understand the price determination under oligopoly here are many of the theories, such as:

- Price Leadership Model

- Kinked Demand Curve Model

- Cournot Duopoly Model

- Chamberlin Model

- Centralised Cartel Model

- Bertrand Duopoly Model, etc.

Kinky Demand Curve

According to the kinky demand curve model, there are not frequent changes in the market prices in case of a non-collusive oligopoly market.

In the case of the kinky demand curve, there is an assumption which says, an in-demand curve there is a kink in the curve is at the ruling price.

Because, of the firm’s significant share of the product, and a powerful influence on the price of the commodity. Under this model, a firm has two choices:

- Increases the price: In an oligopoly market, every firm is very aware of the fact that raises the price of the product, will make the firm lose most of its customers to its rival. The lower part of the demand curve after the kink is less elastic than the curve above the kink.

- Decrease the price: A fall in the prices, increases the total sales, but it doesn’t push up sales very much because the rival firms start cutting down their prices as well. Therefore, oligopoly does not have the policies of cutting prices.

Graph Explanation

In the above-given graph, just below the point corresponding to the kink, there is a discontinuity in the MR curve. Because at the state of equilibrium ON is the level of output and MC intersects the MR curve at this level.

The dotted line represents the discontinuity of the MR curve.

Because of the firms equilibrium at output ON and where the MC curve is intersecting the MR curve the discontinuity of the MR cost curve is drawn.

The demand curve is created by two segments DP and PD’. At point P there is a kink in the demand curve.

For example, an oligopoly firm price for output is 20 per unit, and they sell 240 units of production.

Afterwards, prices are increased to 24 per unit, which gives loss to the firm (a large part of the market), and sales of the firm are 140 units which cause a loss of 100 units.

Price Leadership Model

In this model in an oligopoly market, all the firms follow the price of price leader in the industry and this role is assumed. Price leader decides the price in the market and other firms have to accept the price.

The price leader of the industry is usually the firm that has dominance over the market or having the lowest cost of production in the industry.

This is the conclusion of a price war in which one firm emerges as the winner. In most cases of oligopoly market price are set with the agreements among the firms and these agreements can be either tacit or explicit.

Types of Price Leadership

Price leaderships are differentiated according to the industry and firm types. Following are the different types of price leadership:

The price leadership of a dominant firm: The firm which produces the products in bulk is the price leader who decides the price in the market and other firms have to accept the price.

- Barometric price leadership: The price leadership role is assumed and given to the oldest and largest firm in the industry, but price leader also protects the interest of other firms. Also, in case a dominant firm is a price leader, has to take the decision from other firms perspective as well.

- Exploitative or Aggressive price leadership: In these types of leadership one big firm build supremacy in the entire market by following aggressive price leadership, which forces other firms to follow and accept the same pattern. If other firms start to feel any independence leader firm threatens and coerces the firm.

Price Determination under Price Leadership

Determination of price under a price-leadership model based on certain assumptions regarding the behaviour of the price leader and his followers. Assumptions in case of price-output level:

- There are only two firms, A and B and firm A’s cost of production is lower than firm B.

- Consumers do not have anyone specific favourite firm because products are homogeneous or identical.

The market share of firm A and B are the same which means the demand is also the same for both of these firms.

Price Determination under Price Leadership

- In the above graph, firm A MC is MCa and MCb is the MC curve of firm B.

- Firm B has a higher cost of production than A.

- Firm A will be maximising its profit by selling ON level of output at price MP because at output OM the firm A will be in equilibrium at E where MC = MR.

- Point F is the equilibrium point for firm B, where the price is equal to NK and quantity is equal to ON.

- In order to survive two firms charge the same price.

- Therefore, firm B has to accept and follow the price set by firm A, i:e firm A is the price leader and firm B is a follower.

Because both firms face the same demand curve, B produces an OM level of output. And, MC of B> MC of A. Therefore, firm B earns less profit than A.

Difficulties of Price Leadership

The following are the challenges faced by a price leader in the oligopoly market:

- It is difficult for a price leader to assess the reactions of his followers correctly.

- When price leaders set high prices, other firms may secretly be charging the lower prices.

- Generally, rival firms have non-price competition, i:e sales promotion, advertisement etc.

- High prices in the industry are set by the price leaders and these high prices attract new sellers in the market. But for new firms selling product at higher prices is difficult, which creates a problem between new firms and industry leaders.

Cournot Model

It is simple model of duopoly introduced by French economist Augustin Cournot in 1838 . In Cournot model each firm produces a homogeneous product with market demand known to every firm . Each firm must decide how much to produce at the same time . Market price will depend on total output . Basically there are two firms selling homogeneous product and deciding the price simultaneously along with which they decide how much of the quantity to make .

Essence of cournot model is that each firm treats the output of its competitor as fixed when deciding how much to produce .

Stackelberg Model

Stackelberg model is a sequential move game model in which one firm sets its output before the other firms do . Introduced in 1934 , this model has two firms deciding the quantity to be produced sequentially selling the homogeneous products .

It is also called quantity leadership model . First firm chooses the quantity , then the 2nd firm (knowing the quantity made by the first ) decides the quantity being a follower . Therefore it is often used to describe industries in which there is a dominant firm or natural leader . For example : IBM in computer industry

Cartels model

In Cartels or Collusion model , firms get together and attempt to set prices and quantities to maximize their combined profits , are known as cartels . It is simply a group of firms that jointly collude to behave like a single monopolist and maximize sum of their profits . for example : OPEC ( Organisation of Petroleum Exporting Countries ) cartel

Conditions of cartels success : – highly inelastic market demand curve

- Small incentive to cheat or strict punishment for cheating

Perfect cartel: – price and output determination of the whole industry as well as of each member is determined by the common administrative agency so as to achieve maximum joint profit. The total profit is distributed in a way already agreed upon.

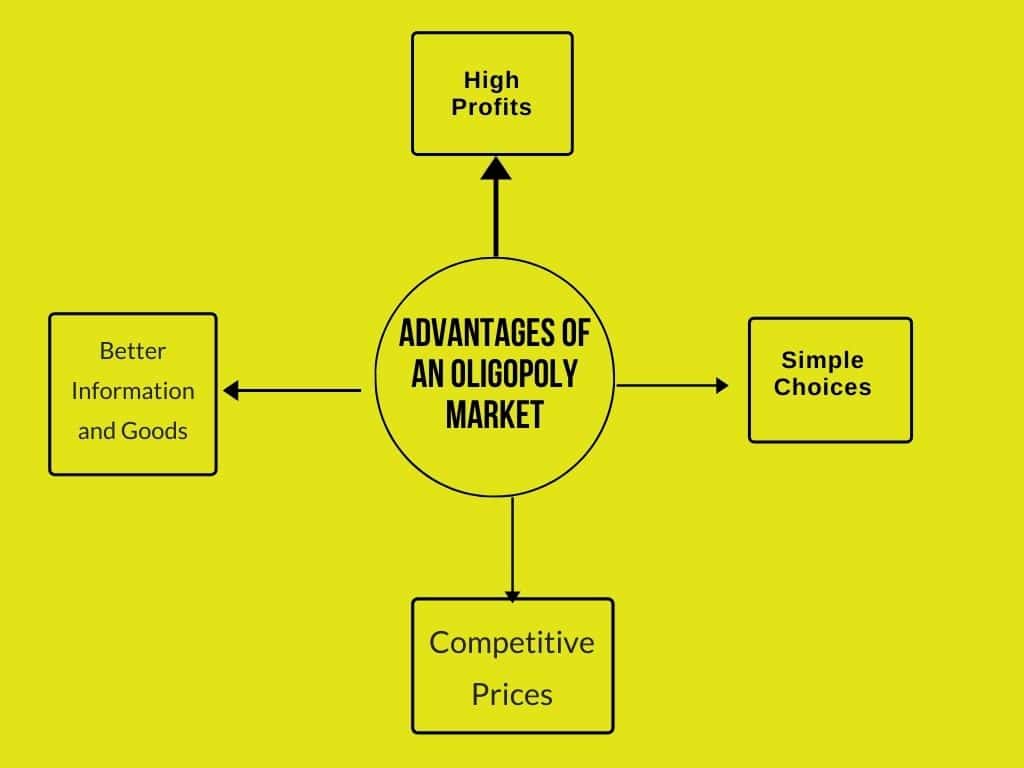

Advantages of an Oligopoly

Here are some advantages of oligopoly market structure for the firms in the industry, customers and the economy. Oligopoly firms are highly competitive which results in these advantages:

High Profits

Due to the presence of a few firms in the industries, firms are able to earn a huge amount of profits. The demand for products that are sold by oligopoly firms are high and in general, these goods are needed or wanted by the large majority of the population.

Simple Choices

Since their a limited number of firms in an oligopoly market, it makes it convenient for the consumers to compare between them and choose the best option for you. It is not possible in any other kind of market, as the competition among sellers is based on features and advertisement of the product.

Competitive Prices

There are only a few firms in the market which makes consumer able to compare the prices of different firms. Due to this reason, firms make sure to keep their prices low as much as possible. As a result, the consumer gets the product at the lowest prices.

Better Information and Goods

In an oligopoly market, price competition and product competition is equally important. Every firm focuses on pursuing the consumer with new and different features, every time company comes up with a new thing in the market. Ti gives the consumer the best information about the product.

Disadvantages of Oligopoly Market

An oligopoly market is also not always beneficial. It has disadvantages to the economy, consumers, and the firm as well.

Difficult To Forge A Spot

In an oligopoly market, huge or big companies have control over the entire market. Because of this, any new or small businesses with new ideas cannot break into the marketplace.

Fewer Choices

The number of firms is limited in the case of oligopoly which becomes a disadvantage for the consumer. In many cases, the consumer has to choose the firm which is the least evil in the case of providing services. As the choices are minimal.

Fixed Prices Are Bad For Consumers

As discussed before price in an oligopoly is fixed with the mutual understanding between the firms and neither of the firms indulge in reducing prices. As it can result in a price war. Ultimately, it causes the consumer to pay a high price.

No Fear Of Competition

Firms that control the market are big corporation firms and they are very settled in their business. Profits and their way of running the firm guarantees the results. which finishes the fear of competition.

Oligopoly Market Examples In India

Here are a few real-life oligopoly market examples in India. These are some of the examples of the market which illustrates the oligopoly market:

- Cable Television Services

- Entertainment (Music and Film)

- Airlines

- Mass Media

- Pharmaceuticals

- Computers & Software

- Cellular Phone Services

- Smart Phone and Computer Operating Systems

- Aluminium and Steel

- Oil and Gas

- Automobiles

Oligopoly market Examples In World

Top three oligopoly market examples in the world. Industries considered as the most oligopolistic firms

Technology Industry

The computer technology sector in the technology sector applies as a good example of oligopoly. Let us list out the computer operating software, and we will find out the two prominent names Apple and Windows.

They both have the majority of the market share for a long. After these two Linux Open Source has the biggest market share.

Apart from three, there are hardly any players in this sector as they command almost 100 % of the global market share. Regardless of the brand of computer, the operating system will always be sure from any of those described above three.

Media Industry

Let us take the media sector in the US, where 5-6 players are capturing almost 90% of this sector. And, the rest 10% share of the market is shared by other small firms.

These firms like Viacom, Disney, Time Warner, NBC have a chunk of viewership. The charge for operating rates and usage terms is significant. And terms of prime time programming and content selection, there is also considerable unity.

Aluminium

The aluminium industry has undoubtedly the highest Technical and economic concentration. The top 6 big companies, Alcoa, Kaiser and Reynolds from the US, Alcan from Canada and Pechiney and Alusuisse from Europe, controls the industry in the period of the Second World War to the 1970s. They had more than 60% of world output.